6th Grade consumer math worksheets: Budgeting, Saving, and Spending

-

Do you want to help your 6th graders learn how to manage money better and make smart financial decisions from now like budgeting, saving, and spending? Your 6th graders might think that consumer math is too complicated or boring for them. Don’t worry! 6th Grade consumer math worksheets are here to simplify everything.

How to help your 6th grader master consumer math skills with fun and engaging worksheets

As we know, consumer math is more than just about numbers and formulas. It is also about real-life situations that affect families every day. Therefore, in collaboration with Mathskills4kids.com, this article will provide a vast collection of fun and engaging worksheets that will help your 6th grader master consumer math skills in no time.

Consumer math can help 6th graders learn how to plan their budget, save for goals, shop wisely, pay their taxes and tips, and avoid common money mistakes. This article will discuss why consumer math is essential for 6th-grade students and how to use worksheets to reinforce it.

We will also provide examples of consumer math exercises your students can practice at home or in the classroom.

-

BROWSE THE WEBSITE

-

DOWNLOAD FREE WORKSHEETS

-

-

GRADE 6 MATH TOPICS

- Whole numbers

- Multiplication

- Division

- Exponents and square roots

- Number theory

- Decimals

- Add & subtract decimals

- Multiply & divide decimals

- Fractions & mixed numbers

- Add & subtract fractions

- Multiply fractions

- Divide fractions

- Integers

- Operations with integers

- Mixed operations

- Rational numbers

- Problems solving

- Ratio & proportions

- Percentages

- Measuring units

- Money math

- Consumer math

- Telling time

- Coordinate graph

- Algebraic expressions

- One step equations

- Solve & graph inequalities

- Two-step equations

- 2D Geometry

- Symmetry & transformation

- 3D Shapes

- Geometry measurement

- Data and Graphs

- Statistics

- Probability

-

-

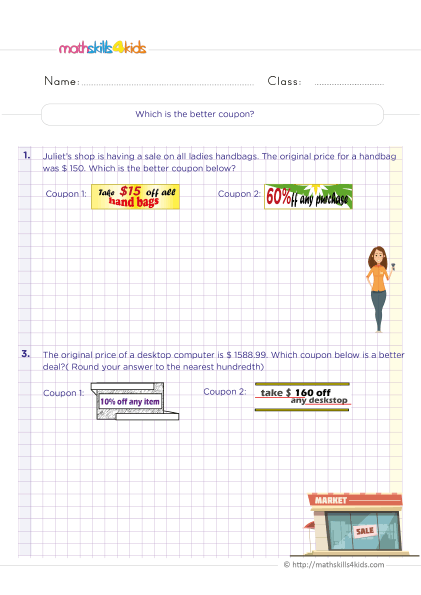

Which is the best deal ?

Print it...

Print it...

-

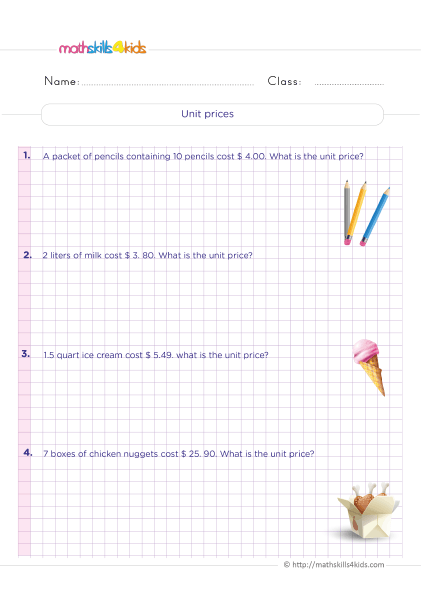

How do you find unit price?

Print it...

Print it...

-

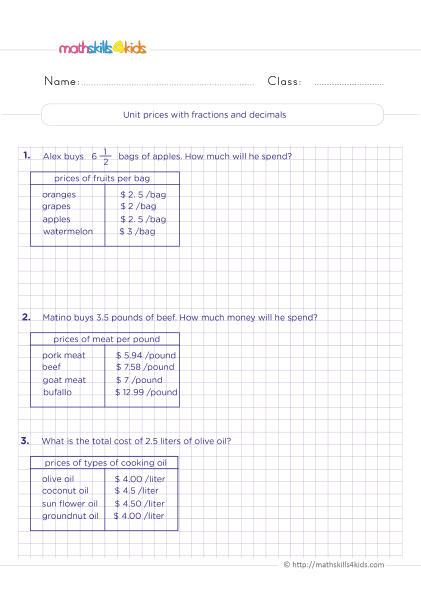

Unit price with fractions and decimals practice

Print it...

Print it...

-

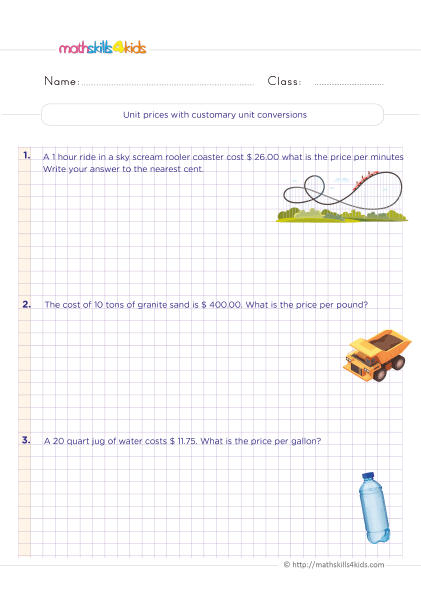

Unit price with customary unit convertions

Print it...

Print it...

-

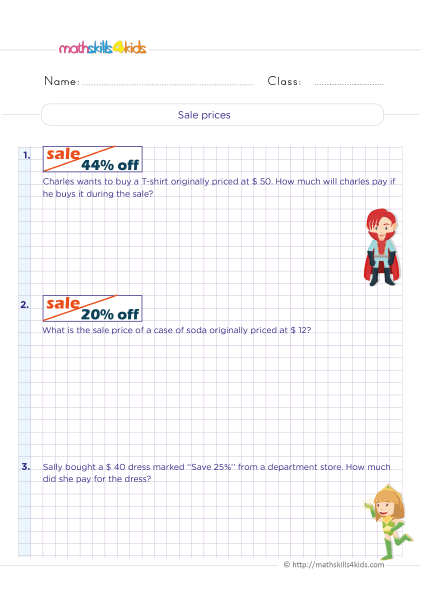

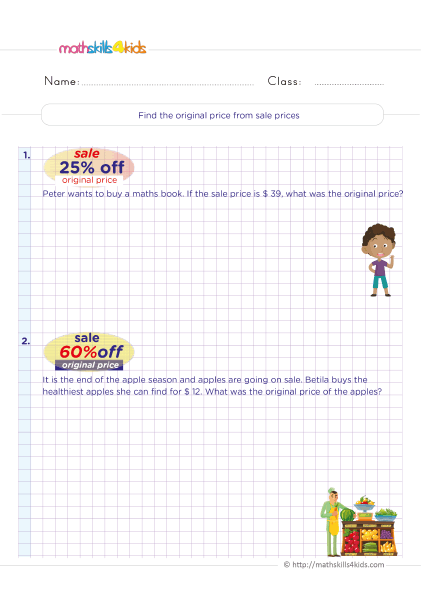

How to find the original price of a discount

Print it...

Print it...

-

How to find the original price from a sale price

Print it...

Print it...

-

Which is the best deal ?

-

Buying is supporting us!

Buy Now...

-

-

Why is consumer math essential for 6th-grade students, and how to use worksheets to reinforce it?

Consumer math is the branch of mathematics that deals with topics related to personal finance, such as income, expenses, savings, investments, taxes, interest, discounts, and more. Consumer math is essential for 6th-grade students because it helps them develop skills and habits that will benefit them throughout their lives. Some of these skills and habits are:

- Critical thinking: Consumer math teaches students to analyze information, compare options, and make informed choices.

- Problem-solving: Consumer math helps us solve real-world problems that involve money and resources.

- Communication: Consumer math helps us communicate effectively with others about financial matters.

- Responsibility: Consumer math helps us take charge of our own money and use it wisely.

- Creativity: Consumer math encourages us to find new ways to save, earn, and spend our money diligently.

One of the best ways to learn consumer math is by using worksheets. Worksheets are printable or digital documents that contain questions, exercises, or activities related to consumer math topics. Worksheets can help 6th graders to practice and reinforce what they learn in class or from other sources.

Worksheets can also help test students' knowledge, check their progress, and identify their strengths and weaknesses. Worksheets can be fun and engaging if well-designed and relevant to students' interests and needs.

-

Budgeting Basics: How to plan and track your expenses

One of the most essential skills students can learn in 6th grade is budgeting their money. Budgeting means planning how much money you have, how much money you need, and how much you want to spend on different things. Budgeting can help you save money, avoid debt, and reach your financial goals.

To start budgeting, we must understand two things: income and expenses. Income is the money we earn or receive from different sources, such as allowance, gifts, or chores. Expenses are the money we spend on different things, such as food, clothes, entertainment, or donations.

We can use a worksheet, a notebook, or an app to plan and track our income and expenses. We can write down how much money we get and how much we spend every day, week, or month. We can also categorize our expenses into different types, such as needs and wants. Needs are the things we have to buy to survive, such as food, water, shelter, or medicine. Wants are the things we buy for fun or pleasure, such as toys, games, movies, or candy.

By tracking our income and expenses, we can see how much money is left at the end of each period. This is called balance. If the balance is positive, we have more money than we spent. If our balance is negative, we spent more money than we had.

A positive balance is good because it means we can save or spend money on something else. A negative balance is bad because it means we have to borrow money or cut back on our spending.

To avoid a negative balance, we need to plan our spending ahead of time. We can do this by making a budget. A budget is a plan that shows how much money we expect to earn and spend in a certain period. A budget can help us control our spending and ensure we have enough money for our needs and wants.

To make a budget, students need to follow these steps:

- Estimate income for the next month. Students can use their past income as a guide or ask their parents or guardians for help.

- List all fixed expenses for the next month. These expenses, such as rent, utilities, insurance, or school fees, stay the same monthly.

- Subtract fixed expenses from income. This is the amount of money one has left for variable expenses.

- List all variable expenses for the next month. These monthly expenses, such as food, clothing, entertainment, or transportation, change monthly.

- Allocate a certain amount of money for each variable expense category. Students can use their past spending as a guide or ask their parents or guardians for help.

- Subtract variable expenses from the money left after paying fixed expenses. This is the money left for savings or extra spending.

- Review the budget and make adjustments if needed. A child can increase or decrease the amount of money allocated for each category depending on his or her needs and wants.

-

Saving and Investing: How to grow our money for the future

Another important skill students can learn in 6th grade is saving and investing money. Saving means putting aside some money for future use. Investing means using some of one's money to buy something that will increase in value over time.

Saving and investing can help us achieve our long-term financial goals, such as buying a car, going to college, or traveling the world. Saving and investing can also help us prepare for emergencies, such as losing a job, getting sick, or having an accident.

To start saving and investing, follow these steps:

- Set a specific and realistic goal for what you want to save or invest in. For example, "I want to save $500 for a new bike by next year" or "Invest $100 in stocks by next month".

- Decide how much money you can afford to save or invest each month. You can use your budget as a guide or ask your parents or guardians for help.

- Choose a safe and convenient place to keep your savings or investments. You can use a piggy bank, a savings account, a certificate of deposit (CD), a mutual fund, or a stock market account.

- Transfer some of your money from your checking account or cash to your savings or investment account every month. You can do this manually or automatically using online banking or an app.

- Monitor the progress of your savings or investments regularly. You can check your balance online or on paper statements.

- Celebrate when you reach your goal and enjoy the benefits of saving or investing.

-

Shopping Smart: How to Compare Prices and Find the Best Deals

A third important skill students can learn in 6th grade is how to shop smart. Shopping smart means buying the things we need or want at the best possible price and quality. Shopping smart can help us save money, avoid waste, and get more value for our money.

To shop smart, follow these steps:

- Do some research before buying anything. Students can use the internet, magazines, catalogs, or flyers to find out more about the product or service they want to buy. They can also ask their friends, family, or experts for their opinions or recommendations.

- Compare prices and quality of different sellers or providers. Students can use online tools like price comparison websites, reviews, ratings, or coupons to find the best deals. They can also visit different stores or websites to see the products or services in person.

- Negotiate for a better price or a better deal. 6th graders can ask for a discount, a freebie, a warranty, or a refund policy. They can also use your bargaining skills, such as being polite, friendly, confident, and firm.

- Check the product or service carefully before paying for it. Children can look for defects, damages, or errors. They can also test the product or service to see if it works properly and meets their expectations.

- Keep the receipt and the packaging of the product or service. Your child can use them as proof of purchase or evidence in case they need to return, exchange, or repair the product or service.

-

Taxes and Tips: How to calculate and pay your fair share

A fourth essential skill students can learn in 6th grade is calculating and paying taxes and tips. Taxes are the money paid to the government for the public services and goods it provides, such as roads, schools, parks, or health care. Tips are the money paid to the workers who provide us with personal services, such as waiters, hairdressers, or taxi drivers.

Taxes and tips can affect our budget and spending decisions. Taxes and tips can also show our responsibility and gratitude as citizens and customers.

To calculate and pay taxes and tips, follow these steps:

- Find out the tax and tip rates for the product or service to be bought. We can use online tools like tax calculators, tip calculators, or tax tables to determine the rates. We can also ask our parents or guardians for help.

- Multiply the price of the product or service by the tax and tip rates. This will give us the tax and tips we must pay.

- Add the price of the product or service, the tax amount, and the tip amount. This will give us the total amount we have to pay.

- Pay the total amount using cash, card, check, or online payment. We can also round up or down the total amount to make paying easier.

- Keep the receipt and check if the tax and tip amounts are correct. We can also write a thank-you note or compliment the seller or provider.

-

Common money mistakes to avoid in 6th Grade

A fifth important skill students can learn in 6th grade is avoiding common money mistakes. Money mistakes are actions or decisions that can harm our financial situation or prevent us from reaching our financial goals.

Money mistakes can cost us money, time, energy, or opportunities. Money mistakes can also damage our reputation, relationships, or happiness.

To avoid common money mistakes in 6th grade, students need to be aware of these examples:

- Spending more than we earn or have

- Not saving enough money for our needs and wants

- Not investing our money wisely

- Not shopping smartly

- Not paying taxes and tips correctly

- Not tracking our income and expenses

- Not making a budget

- Not following our budget

- Not setting financial goals

- Not reviewing our financial progress

- Not learning new financial skills

- Not asking for help when we need it

- Not being honest about our money situation

- Not being responsible with our money

- Not being grateful for what we have

-

How to compare prices and find the best deals: 5 engaging Mathskills4kids’ exercises for 6th Graders

One of the most important consumer math skills is comparing prices and finding the best deals when shopping. This can help us save money, avoid overspending, and get more value for our purchases. Here are five exercises from Mathskills4kids.com that you can do with your 6th graders to practice this skill:

- Unit Price: The unit price is the cost per unit of a product, such as per ounce, pound, or item. We divide the total price by the number of units to find the unit price. For example, if a pack of 12 pencils costs $3.60, the unit price is $3.60 / 12 = $0.30 per pencil.

To compare the prices of different products, we can use the unit price to see which is cheaper or more expensive per unit.

For example, if another pack of 10 pencils costs $2.50, the unit price is $2.50 / 10 = $0.25 per pencil. This means the second pack is cheaper per pencil than the first one.

Exercise: Find the unit price of each product and compare them to see which is the best deal.

- A bag of 20 apples for $5

- A bag of 15 apples for $4

- A bag of 10 apples for $3

Answer:

- The unit price of the first bag is $5 / 20 = $0.25 per apple.

- The unit price of the second bag is $4 / 15 = $0.27 per apple.

- The unit price of the third bag is $3 / 10 = $0.30 per apple.

Therefore, the first bag is the best deal because it has the lowest price per apple.

- Percent Discount: A percent discount is a reduction in the original price of a product by a certain percentage. To find the percent discount, we divide the amount of the discount by the original price and multiply by 100%.

For example, if a shirt that costs $20 is on sale for $15, the discount is $20 - $15 = $5. The percent discount is $5 / $20 x 100% = 25%. This means that the shirt is 25% off its original price.

Exercise: Find the percent discount of each product and compare them to see which one has the biggest savings.

- A pair of jeans that costs $40 is on sale for $32

- A pair of jeans that costs $50 is on sale for $40

- A pair of jeans that costs $60 is on sale for $48

Answer:

- The percent discount of the first pair is ($40 - $32) / $40 x 100% = 20%.

- The percent discount of the second pair is ($50 - $40) / $50 x 100% = 20%.

- The percent discount of the third pair is ($60 - $48) / $60 x 100% = 20%.

All three pairs have the same percent discount, so they have the same savings.

- Sales Tax: Sales tax is an extra amount we pay when we buy something, based on a percentage of the price. The sales tax rate varies depending on where we live and what we buy. We multiply the price by the sales tax rate to find the sales tax.

For example, if a book costs $12 and the sales tax rate is 8%, the sales tax is $12 x 0.08 = $0.96. To find the total price, we add the sales tax to the price. For example, if a book costs $12 and the sales tax rate is 8%, the total price is $12 + $0.96 = $12.96.

Exercise: Find each product's sales tax and total price, assuming a sales tax rate of 7%.

- A bike that costs $150

- A helmet that costs $25

- A lock that costs $10

Answer:

- The sales tax of the bike is $150 x 0.07 = $10.50. The total price of the bike is $150 + $10.50 = $160.50.

- The sales tax of the helmet is $25 x 0.07 = $1.75. The total price of the helmet is $25 +$1.75 =$26.75.

- The sales tax of the lock is$10 x 0.07 =$0.70.The total price of the lock is $10 +$0.70 =$10.70.

- Tip: A tip is an extra amount we pay when we receive a service, such as at a restaurant or a salon. It is usually based on a percentage of the bill. To find the tip, we multiply the bill by the tip rate.

For example, if our bill is $30 and we want to leave a 15% tip, the tip is $30 x 0.15 =$4.50. We’ll add the tip to the bill to find the total amount we pay.

For example, if our bill is $30 and we want to leave a 15% tip, we’ll pay $30 +$4.50 =$34.50.

Exercise: Find the tip and the total amount we pay for each service, assuming a tip rate of 18%.

- A haircut that costs $25

- A manicure that costs $15

- A massage that costs $60

Answer:

- The tip for the haircut is $25 x 0.18 = $4.50. The total amount we’ll pay for the haircut is $25 + $4.50 = $29.50.

- The tip for the manicure is $15 x 0.18 = $2.70. The total amount we’ll pay for the manicure is $15 + $2.70 = $17.70.

- The tip for the massage is $60 x 0.18 = $10.80. The total amount we’ll pay for the massage is $60 + $10.80 = $70.80.

- Coupon: A coupon is a voucher that gives us a discount on a product or a service. To use a coupon, we subtract the value of the coupon from the price of the product or the service.

For example, if a pizza costs $10 and we have a coupon that gives us $2 off, we’ll pay $10 - $2 = $8 for the pizza.

Exercise: Find the price you pay for each product or service after using the coupon.

- A movie ticket that costs $12, and you have a coupon that gives you 50% off

- A pair of shoes that costs $80, and you have a coupon that gives you $20 off

- A subscription to an online game that costs $5 per month, and you have a coupon that gives you one month for free.

Answer:

- The price that you pay for the movie ticket after using the coupon is $12 x 0.50 = $6.

- The price that you pay for the pair of shoes after using the coupon is $80 - $20 = $60.

- The price you pay for the subscription to the online game after using the coupon is ($5 x 12) - $5 = $55.

- Unit Price: The unit price is the cost per unit of a product, such as per ounce, pound, or item. We divide the total price by the number of units to find the unit price. For example, if a pack of 12 pencils costs $3.60, the unit price is $3.60 / 12 = $0.30 per pencil.

Bonus: Where to find more resources for 6th-grader Consumer Math

If you want to help your 6th grader learn more about consumer math and practice their skills, there are many online resources that you can use. Here are some of them:

- gov Free Publications: This website offers a variety of publications on consumer math topics, such as budgeting, banking, credit, identity theft, and more. You can also find worksheets to help your students work through the concepts. You can access the publications here: https://consumer.gov/content/make-budget-worksheet

- Money Prodigy: This article has a lot of suggestions and tips on how to manage our money and become financially savvy. You can also find 19 free consumer math worksheets for middle and high school students on buying plans, discounts, taxes, and more. You can download the worksheets here: https://www.moneyprodigy.com/consumer-math-worksheets/

- Mashup Math: This website has a vast collection of free 6th-grade math worksheets, videos, puzzles, and games that cover various topics, including consumer math. Your 6th graders can practice fractions, decimals, geometry, algebra, and more. You can access the resources here: https://www.mashupmath.com/6th-grade-math-resources-sneeze

- study.com: This website has a series of video lessons and quizzes on consumer math for 6th-8th graders. They can learn about interest rates, sales tax, discounts, tips, unit prices, etc. They can watch the videos and take the quizzes here: https://study.com/academy/topic/6th-8th-grade-math-consumer-math.html

- Math Goodies: This website has a section on consumer math that covers topics like percent applications, simple interest, compound interest, installment buying, depreciation, etc. 6th graders can read the lessons and do the exercises here: https://www.mathgoodies.com/lessons/consumer-math

-

-

Thank you for sharing the links of MathSkills4Kids.com with your loved ones. Your choice is greatly appreciated.

Conclusion

Consumer math is not just something we learn in school. It is something we use every day in real life. Whether shopping, saving, investing, paying taxes, or making financial decisions, we must use consumer math skills to make smart choices and avoid mistakes.

Some of the benefits of learning consumer math are:

- We can budget our money and track our expenses

- We can save and invest our money for the future

- We can compare prices and find the best deals

- We can calculate and pay our fair share of taxes and tips

- We can avoid common money mistakes like overspending, borrowing too much, or falling for scams

Consumer math is essential for 6th-grade students because it helps them develop financial literacy and prepare for adulthood. By using Mathskills4kids’ 6th Grade consumer math worksheets and online resources, you can reinforce your 6th graders’ consumer math skills and have fun at the same time.